Year-End Special: My 2026 Economic and Market Forecasts

Silver didn’t just rally in 2025 — it broke out. After blasting through the multi-decade $50 ceiling and printing a violent spike into the $80s,

Silver didn’t just rally in 2025 — it broke out. After blasting through the multi-decade $50 ceiling and printing a violent spike into the $80s,

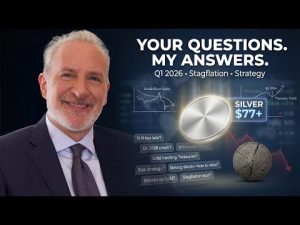

This is Part 2 (Q&A) of Peter Schiff’s X Spaces following the historic metals breakout. With silver near $77, platinum at all-time highs, and gold

Silver just ripped to roughly $77 in a historic breakout, platinum hit an all-time high, and gold is pushing $4,500+—while Bitcoin and crypto-related trades show

I pointed out the obvious: the housing crisis is government-made. Artificially low interest rates and easy credit pushed prices up, and now prices need to

Peter Schiff forecasts an imminent Bitcoin crash, critiques Trump’s economic policies, and highlights the surging silver market in this episode of The Peter Schiff Show.

⭐️ Sign up for Peter’s most valuable insights at https://schiffsovereign.com 🔔 Free Reports & Market Updates: https://www.europac.com 🟨 Gold News: http://www.schiffgold.com/news 📘 Book Store: https://schiffradio.com/books

This is Part 2 (Q&A) of Peter Schiff’s X Spaces following the historic metals breakout. With silver near $77, platinum at all-time highs, and gold

Silver just ripped to roughly $77 in a historic breakout, platinum hit an all-time high, and gold is pushing $4,500+—while Bitcoin and crypto-related trades show

I pointed out the obvious: the housing crisis is government-made. Artificially low interest rates and easy credit pushed prices up, and now prices need to

This episode is sponsored by NetSuite. Download the free “demystifying ai” at https://netsuite.com/gold